A borrower asks a financial institution for a financing, and the financial institution extends money to the buyer and keeps the car loan on its publications for the finance's term. That's Financial 101-- yet it's less commonly exactly how things are done today in the home loan market. Member First Mortgage is owned by 11 cooperative credit union as well as manages its mortgages in-house instead of offering them to larger financial institutions. Luckily, there's a 60-day grace period for payments after your home mortgage is marketed. Throughout this time, you can not be charged a late fee for wrongly sending your home loan repayment to your previous instead of brand-new loan provider. Any late repayments made during this time duration also can not be reported to credit score companies.

- The infusion of capital from financiers supplies mortgage loan providers such as financial institutions, thrifts, home loan bankers and various other lending originators with a market for their loans.

- A mortgage bond is a bond backed by a pool of mortgages on a realty asset such as a home.

- To learn whether any of your funds purchases CMOs, and also if so, how much, examine your fund's prospectus or SAI under the headings "Investment Objectives" or "Financial investment Plans."

- We've offered some helpful web links listed below where you can find out more info.

Some exclusive institutions also securitize home mortgages, known as "private-label" home loan securities. Issuances of private-label mortgage-backed securities boosted considerably from 2001 to 2007 and then finished suddenly in 2008, when property markets began to falter. An example of a private-label provider is the realty mortgage investment conduit, a tax-structure entity normally utilized for CMOs; among other points, a REMIC structure stays clear of supposed https://www.canceltimeshares.com/blog/why-are-timeshares-a-bad-idea/ dual taxes.

Changes To Adapting Lending Limits

Hanna Kielar is an Area Editor for Rocket Vehicle ℠, RocketHQ ℠, and Rocket Loans ® with a concentrate on personal financing, auto, as well as personal lendings. Basic interest is a computation of passion that doesn't consider the result of intensifying. In many cases, interest substances with each marked period of a loan, however in the case of simple passion, it does not. The calculation of straightforward passion amounts to the primary amount multiplied by the rate of interest, increased by the number of durations. What you need to look out for are prospective adjustments in your finance servicer. Lenders are legally called for to inform you of your finance sale before it occurs.

What Is A Mortgage

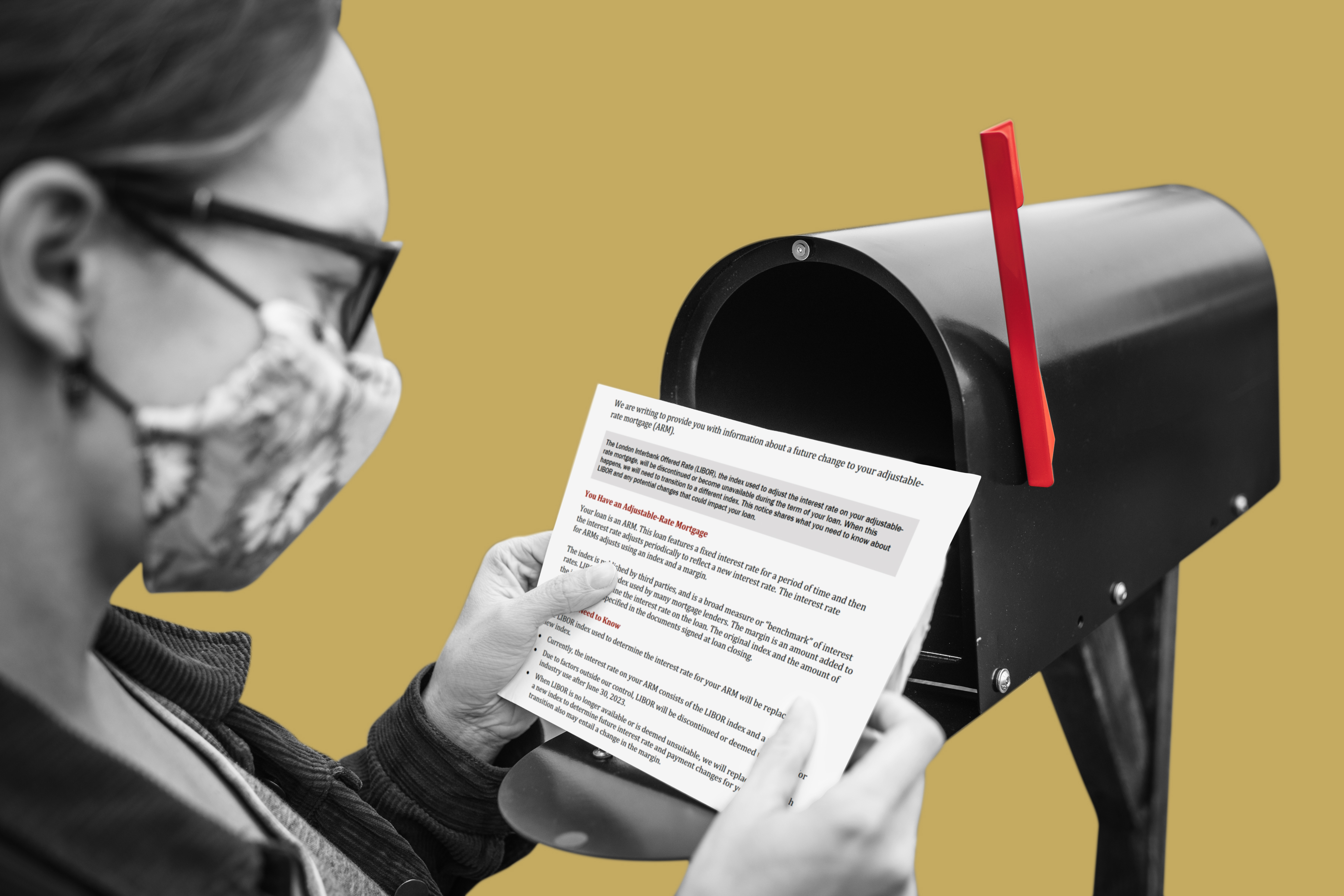

Your servicer is the Browse around this site entity that manages your mortgage payments after shutting. Occasionally these entities coincide, yet other times, your loan provider will certainly route you to a third-party company that deals with loan servicing for them. It's extremely typical for mortgage to be marketed, as well as it's not a cause for alarm. You should receive notice in the mail both before as well as after the sale happens.

Home mortgages are car loans that are used to purchase houses and various other sorts of property. Julia Kagan has actually discussed personal finance for greater than 25 years and for Investopedia because 2014. The previous editor of Consumer Reports, she is a specialist in credit scores and financial debt, retired life planning, own a home, employment issues, as well as insurance policy. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington University. Lenders can, nevertheless, oblige you to open up a payment or savings account with them, from which you will certainly settle the lending. They might propose a policy to you in a package with your home loan credit history contract; but this can not be made a problem for you to acquire the home mortgage credit history.