Beneath the surface area, though, there are a lot of moving parts. Even little options in how you prepare for homeownership, or what type of home loan you get, can have big consequences for your checking account. It's all about dealing with a lender you feel comfy with and you trust to comprehend your scenario, states Kevin Parker, vice president of field home mortgage at Navy Federal Credit Union.

In simply the past few months, the way you set about purchasing a house has changed, as the market has adapted to a significantly remote process. In the middle of a pandemic and recession, it's even more crucial to understand what you'll need for a smooth mortgage process.Get Your Finances in OrderGet Preapproved for a Home mortgagePurchase the Right Home Mortgage and Loan ProviderNavigate the Underwriting and Closing ProcessBuying a house, especially if it's your very first time, can be a complicated and stressful procedure.

Dealing with an experienced property representative and lender or mortgage broker can help you navigate the process. Preparing your financial resources is significantly important provided how cautious lending institutions have actually become. Sean Moss, the director of operations for Deposit Resource, an aggregator of property buyer assistance programs, suggests you start the process by talking with a loan officer.

You must concentrate on 2 things: Building your credit and conserving your cash. Having more cash on hand and a more powerful credit history will help you have the ability to afford a wider range of houses, making the time it takes to fortify both well worth it. Your approval odds and mortgage choices will be better the greater your credit score.

Our What Is The Interest Rate On Mortgages Today Statements

The lower your credit history, the higher your mortgage rate of interest (and therefore funding costs). which of the following statements is true regarding home mortgages?. So enhancing your credit by paying your bills on time and settling financial obligation can make a mortgage more budget-friendly. 2 of the best things you can do to get the best home loan rates: taking the time to construct up your credit rating and conserving for a deposit of a minimum of 20%.

You'll need a big chunk of money to pay in advance closing expenses and a deposit. Closing costs consist of all charges connected with processing the mortgage and average 3% -6% of the purchase price. A healthy deposit will be 20% of the house's worth, though it is possible to purchase a home with a smaller sized deposit, especially for particular types of loans.

However do not let that number prevent you from making house ownership a reality. There are ways to bring it down. There are local and regional programs that provide closing expense and down payment help for certified buyers, typically newbie homeowners or purchasers with low-to-moderate earnings. This support usually is in the kind of a grant, low or no-interest loan, or a forgivable loan.

This assists the customer keep money in savings so they're better prepared for emergencies and the extra costs of homeownership. Getting preapproved for a mortgage gives you an excellent idea of just how much you can borrow and shows sellers you are a qualified purchaser. To get a preapproval, a lender will inspect your credit history and evidence of your earnings, properties, and work.

What Is The Current Apr For Mortgages Things To Know Before You Buy

The majority of preapproval letters stand for 60-90 days, and when it comes time to obtain a home loan all of your information will require to be reverified. Also, don't confuse preapproval with prequalification. A prequalification is a quick quote of what you can obtain based upon the numbers you share https://postheaven.net/denopexq93/if-they-desire-to-make-monthly-payments-and-use-some-of-the-cash-for-other and doesn't need any documentation.

When looking for a home mortgage it's a good idea to go shopping around to compare rates and costs for 2-3 lending institutions. When you submit a mortgage application, the lender is required to give you what is referred to as a loan estimate within 3 organization days. Every loan quote contains the very same info, so it's easy to compare not only rate of interest, however also the upfront charges you'll need to pay.

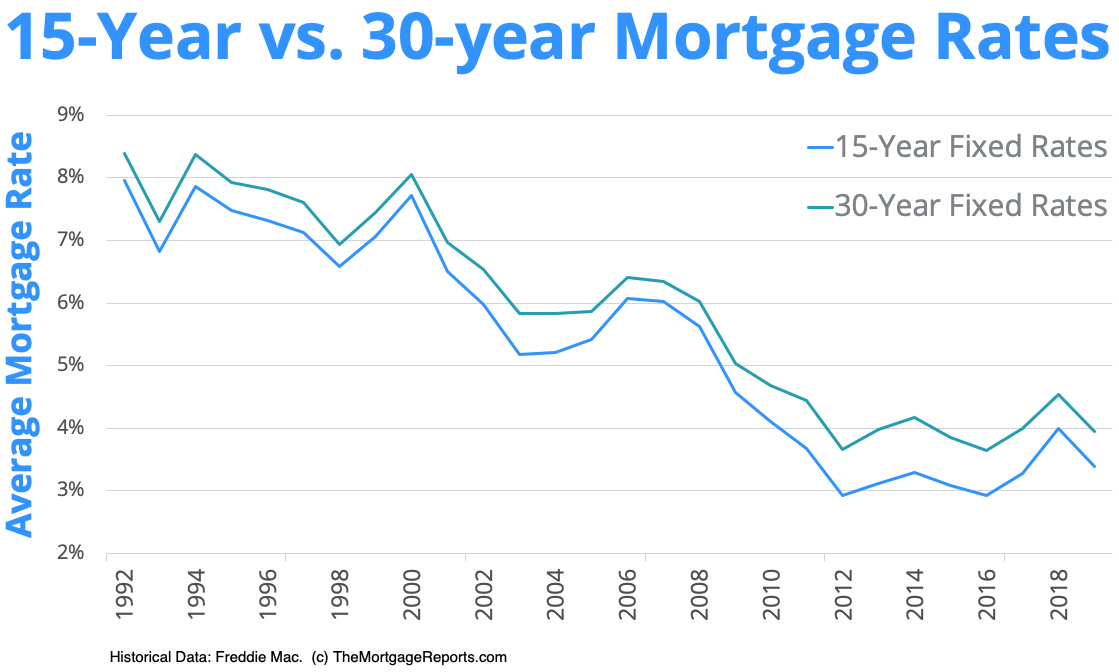

It's also crucial to understand the different mortgage terms. The term is the amount of time the loan is paid back over common home mortgage terms are 10, 15, and thirty years. This has a huge influence on your monthly payment and just how much interest you pay over the life of the loan.

A shorter-term loan will conserve orange lake timeshare you money on interest. This is due to the fact that much shorter loans generally have lower interest rates, and you're paying the loan off in a shorter amount of time. To comprehend how various terms impact your bottom line, utilize our home loan calculator to see how timeshare presentations the month-to-month payment and the total interest you'll pay changes.

What To Know About Mortgages In Canada Things To Know Before You Buy

There are fixed-rate loans, which have the same interest throughout of the mortgage, and adjustable rate home loans, which have a rates of interest that alters with market conditions after a set number of years. There are likewise what are referred to as government-backed loans and standard loans. A government-insured home loan is less dangerous for the lender, so it may be much easier to receive, however features additional limitations.

Department of Agriculture (USDA) are just provided for residential or commercial properties located in a qualifying rural area. Likewise, the private mortgage insurance coverage requirement is usually dropped from conventional loans when the loan-to-value ratio (LTV) is up to 80%. However for USDA and Federal Real Estate Administration (FHA) loans, you'll pay a version of home loan insurance coverage for the life of the loan.

Your financial health will be carefully inspected throughout the underwriting procedure and prior to the home loan is provided or your application is rejected. You'll need to provide recent documents to confirm your employment, income, possessions, and financial obligations. You may also be required to submit letters to discuss things like employment spaces or to document gifts you get to assist with the deposit or closing costs.

Prevent any big purchases, closing or opening brand-new accounts, and making unusually big withdrawals or deposits. As part of closing, the lender will need an appraisal to be completed on the house to validate its worth. You'll likewise need to have a title search done on the residential or commercial property and secure loan provider's title insurance coverage and property owner's insurance.

Top Guidelines Of When Did 30 Year Mortgages Start

Lenders have become more strict with whom they want to loan cash in reaction to the pandemic and ensuing financial recession. Minimum credit rating requirements have increased, and loan providers are holding customers to higher standards. For example, lending institutions are now verifying employment right before the loan is settled, Parker says.

Lots of states have fasted lane approval for making use of digital or mobile notaries, and virtual home tours, " drive-by" appraisals, and remote closings are becoming more common - what credit score do banks use for mortgages. While lots of loan providers have refined the logistics of approving home mortgage remotely, you may still experience delays in the process. All-time low mortgage rates have caused a boom in refinancing as existing homeowners want to conserve.

Spring is typically a hectic time for the realty market, however with the shutdown, lots of purchasers had to put their home searching on pause. As these buyers go back to the market, loan producers are ending up being even busier.